The Rise of the Mom-and-Pop

The Renaissance

There's a beautiful thing that stems from Bitcoin:

An increase in high quality, personable mom-and-pop businesses.

We'll use grocery stores as an example.

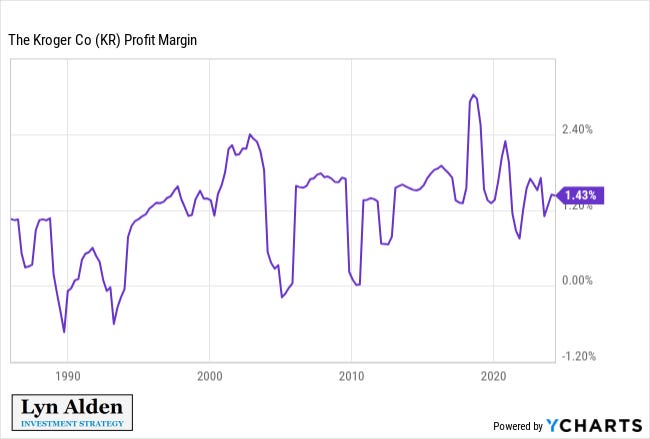

Grocery stores operate on extremely tight margins (1-2%), as evidenced below.

Imagine a mom-and-pop grocery store in this world. In a given year, they generate $1 million in revenue on 1% margins, leaving them with $10,000 in profits.

That is simply unsustainable.

In today's world, that $10,000 only goes down in value each year due to inflation, making the razor-thin profit margin that much more of a burden.

The result of this reality is a world where mom-and-pop businesses get destroyed and large scale, industrialized monopolies form.

1% margins aren't necessarily a problem if you have hundreds of storefronts.

For example, Kroger has over 2,700 stores in the United States.

If each store generated the same mom-and-pop $1 million in revenue, that would be $2.7 billion for the year, giving them $27 million in profits.

Much more doable.

But, what is lost on consumers is the irreplaceable personable touch and focus on quality that comes with a mom-and-pop shop.

What we're left with is monotonous grocery stores (and other businesses) peddling low quality industrial sludge.

How does Bitcoin fix this?

The one word answer is "deflation," which is the opposite of "inflation," but let's break down what that means.

There's two terms to remember when it comes to deflation and inflation.

1) Cost of production

2) Purchasing power

In an inflationary world, the cost of production increases, while purchasing power of money decreases.

Exhibit A: Massive money printing took place in 2020 and 2021, resulting in the cost of production increasing:

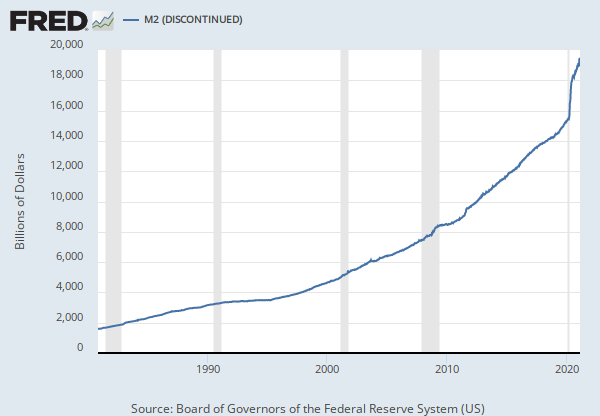

But hold on a minute. Money printing doesn't and didn't just occur in 2020 and 2021, central banks and governments print new money every year, measured by M2 money supply:

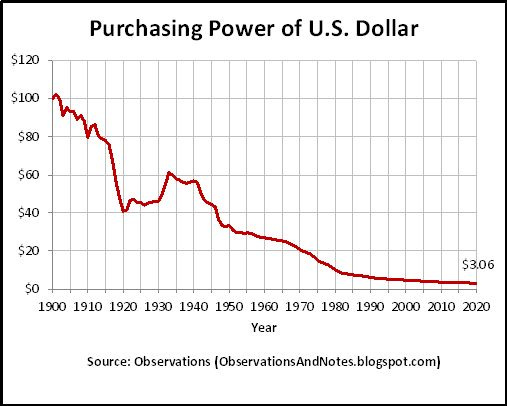

As newly printed money enters the economy (inflation), purchasing power goes down. If that were true, the purchasing power of the US Dollar will have decreased in line with the printing of money. Let's see:

Inflation (newly created money) increases the cost of production and decreases purchasing power.

This most certainly affects producers and consumers.

Imagine Kroger sells a loaf of bread for $10. They produce it for $5, giving them a profit margin of 50%.

New money is printed (inflation), causing the cost of production to increase to $6.

Kroger is left with three main options:

1) Increase the sale price to $12 to maintain their margins

2) Keep the price, but decrease the cost of production by using cheaper, lower-quality ingredients to make the loaf of bread

3) Keep the price, but decrease the size of the loaf of bread so they don't have to produce as much bread (shrinkflation)

All three options hurt the consumer. They are either left with 1) a higher priced good 2) a lower quality good 3) less of the good or 4) a combination of all three.

Why do you think prices are higher? Inflation.

Why do you think cheap, low quality seed oils are in everything? Inflation.

Why do you think we are getting unhealthier? Inflation.

Why do you think mom-and-pop businesses struggle to survive? Inflation.

Inflation occurs because central banks and governments can print money out of thin air.

As Jeff Booth says, "When you think how ludicrous it is that all trade between humans rests on a control structure where a small number of people can create money out of nothing, all of the other problems in the world start to make a lot more sense."

Bitcoin was explicitly created to eradicate arbitrary inflation forever.

That is the point. Nobody can print bitcoins out of thin air. There will never be more than 21 million bitcoins in existence.

That fixed supply of bitcoins is what will fix the world.

The natural order of humanity and technological advancement is deflation.

Which means the natural order of humanity and technological advancement is perpetually decreasing costs of production and increasing purchasing power.

Think about it. Are we better and more efficient at manufacturing a car today than we were 100 years ago?

To fill you in, it took 93 minutes for a car to come off the assembly line in 1913. Today, it takes 45-90 seconds. (https://maycointernational.com/blog/a-history-of-the-automotive-assembly-line/)

Then why has the cost of a car gone up?

It is because we are measuring our economy in an inflationary money.

Of course the cost of production and price of a car (and everything else) is going to go up when the amount of money in the economy goes up.

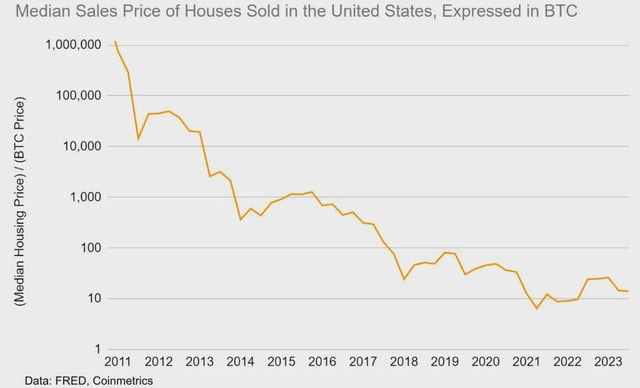

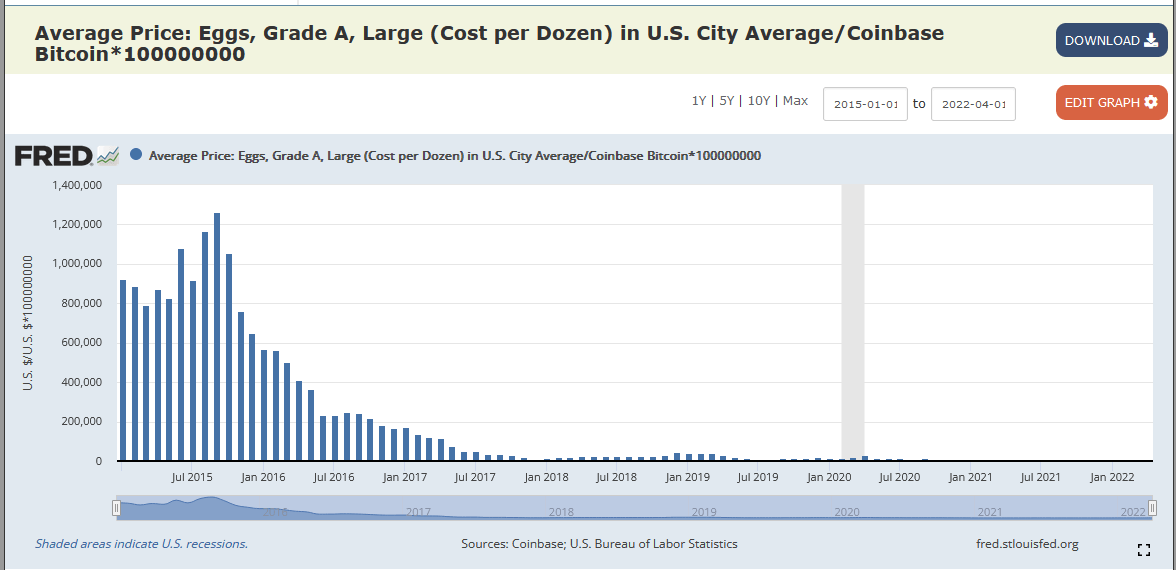

What would happen if we measured our economy in a money that wasn't inflationary and was rather fixed in supply, such as... Bitcoin?

The cost of production of practically everything naturally goes down as technology advances.

Instead of distorting that productivity increase by pricing it in an inflationary money, we price it in Bitcoin, and we rediscover the natural order of technological advancement.

In the Bitcoin world, the cost to produce the loaf of bread goes from $5 to $4 as technology advances (do you think we are more efficient at making bread than we were in the past? Then it should cost less to make it).

Magical things happen as a result:

-The producer can decrease the price to $8 and keep their 50% margins.

-The producer can make a higher quality product for a slightly higher cost of $4.50, and still sell it for a lower cost ($9) to keep their margin.

-Or, the producer can make more bread for $5, keep the price at $10, and keep their margin.

In all scenarios, the consumer benefits.

The complete opposite of today's inflationary world.

This is Bitcoin. This is the world that is awaiting us.

But how does this help the success of mom-and-pop shops?

1) Because everything in the economy is getting more affordable as the cost of production goes down and purchasing power goes up, it is perpetually easier to survive on less money.

2) Because the supply of bitcoins are absolutely scarce (which results in purchasing power going up and costs of goods and services going down), economic participants become both subconsciously and consciously more selective about where and who they give their bitcoin to.

A wider and wider percentage of the market will realize if they don't spend their bitcoin today, they will be able to buy more goods and services tomorrow (the nature of what it means to save). This means a producer must produce a highly valuable good or service to get a consumer to part ways with their bitcoin. Bitcoiners don't buy Taco Bell with their bitcoin.

This results in perpetually higher quality goods being presented to the market, which plays into the personal touch and care a mom-and-pop is able to deliver vs a large scale chain (and which benefits the consumer again).

As the world has grappled with broken money over the last few decades, there has been a shift from the localized mom-and-pop to the industrialized mega corporation, and we have suffered as a result.

The shift from low quality industrial sludge produced by mega corporations back to high quality local love produced by mom-and-pops will not happen overnight, but there will be a change over time as the previously stated two realities unfold.

Inflation vs deflation.

Did you notice that the underlying monetary system and ever-increasing debt total were never mentioned once during the U.S. Presidential debates?

The politicians aren't going to save the world. Stop acting like they are, stop voting like they are.

Vote for Bitcoin.

The only way we fix the world is if we fix the money.

Nothing else matters until that takes place.

![2023-05-09] Revisiting Farm Production Expenses | Senate Committee On... 2023-05-09] Revisiting Farm Production Expenses | Senate Committee On...](https://substackcdn.com/image/fetch/$s_!Ddb-!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Ff1cd7e88-1dc6-49f0-a3d6-00c1cf8812c4_2166x1218.jpeg)

Brilliant article 👏