Bitcoin the Asset: Savings Technology

This is a free chapter from my upcoming book, “The Bitcoin Thesis.”

The book is not complete (in reality, it actually is, time is simply catching up), but the string of words and ideas the universe has formulated together through my being so far is too powerful to keep the thing, at least part of it, a hidden secret any longer.

This is a first-ish draft, I finished the chapter two days before this publishing and ran through and edited it a day ago. The core ideas I wanted to discuss are there, but there is plenty of room for new ideas and/or a remodeling of the current ideas, should the universe whisper in my ear.

I felt called to share this particular chapter at this moment because, as Bitcoin chugs up in price, many come into the space with speculation on their mind, not really knowing what they are buying. I was that guy in early 2021… Had no idea what I was getting myself into in so many ways. I can’t help but laugh.

It’s been an unbelievable journey since then, and I have no doubt it will continue to be. Writing this book has been an unqualifiable amount of fun. I have learned so much, yet I know I am still falling through the most glorious bottomless pit of exploration and wonder I’ve been blessed to discover. That doesn’t even begin to encapsulate it.

Cheers to Satoshi Nakamoto.

Enjoy :)

“It’s very rare that you find a technology that solves every rich person's problem and every poor person's problem simultaneously.”

-Michael Saylor

When you earn money, you are presented with a problem. How do you make sure the value of your money holds up over time? If you earned money and its value became worthless the next day, that would be problematic. You’d have to spend your money immediately. You’d have no ability to save for your future.

Money is a savings tool, that is one of its primary functions; a store of value. You receive money, you save the money, and the value of the money is stored over time so that you can rightfully use it at a later date. The idea of saving money is simple: you save today for a better tomorrow.

Fiat fundamentally destroys the idea of saving money. When you save fiat today, you are in a worse position tomorrow. Your money is worth less tomorrow, and even less a year from now, even less five years from now, and even less twenty years from now. Your money is perpetually worth less over time.

You know why this is. Fiat is perpetually inflationary. The money supply increases year after year, and as a result, the value of the money decreases year after year. If you save in fiat, you are choosing to devalue your money over time. If you save in fiat, you are holding up a sign to the market saying, “I want to be poorer tomorrow.”

The market, or at least, a portion of the market, understands this. If you want to store the value of your money, you can’t save in fiat. You have to choose something else. The question then becomes, what do you choose?

Logically, the market would choose something that is stable, hard to inflate, low-risk, and valued by the rest of the market. How about a publicly-traded financial instrument that indexes the value of the 500 most prosperous companies in the most prosperous country in the world? In other words, how about the S&P 500?

Look deeper, and you’ll realize the value of the S&P 500 is highly correlated to the supply of global fiat money. Put another way, when the supply of money goes up, the value of the S&P 500 goes up. But, don’t trust, verify.

(https://www.apolloacademy.com/sp500-vs-m2/0 )

What a surprise. If you’ve bought and held the S&P 500, the value of your money hasn’t actually gone up, it has merely balanced out the monetary devaluation that has stemmed from inflation. Your money has the same purchasing power today as it did in the past. The S&P 500 has been adopted as the de facto savings tool by the fiat financial system, because the tool that is supposed to serve as savings, the money, fails to do so. This isn’t the only de facto savings tool that’s been adopted, however.

Stable, hard to inflate, low-risk, and valued by the rest of the market. How about real estate? Land is a hard asset, it’s difficult to construct new buildings, plus, humans are going to continue to seek and value shelter. Fiat money is infinite in supply. You won’t maintain the value of your money by storing it in fiat, but you have a chance of maintaining your value if you store it in something that is more scarce than fiat. Savers have flocked to real estate because of its scarce supply, and because it is scarce, at least, more scarce than fiat, it stores value better than fiat. This triggers a feedback loop.

The money supply is inflated, savers seek stores of value outside of the money, turning them into risk-taking investors, some choose to buy real estate, the real estate more effectively stores their value compared to the dollar, causing the real estate to appreciate in value against the dollar, word on the street grows that real estate is a good investment, more people buy real estate, repeat from step one.

As investment money floods in, prices get driven up. As a result, shelter, a basic human need, becomes less and less affordable for the average person over time.

https://prosperousamerica.org/house-prices-move-further-out-of-reach-for-young-families/ (Source: Median household income and home prices from the U.S. Census Bureau; CPI data from U.S. Federal Reserve Bank of Minneapolis, CPA calculations)

Many kick and scream at how difficult it is to buy and own a home in the 21st century, especially when compared to older generations. At this point, you should know why this is. The money is worth less over time. Your grandpa had more purchasing power than you, of course it was easier for him to afford a home. The money being worth less over time stems from monetary inflation, which stems from an infinite money monopoly granted to central banks via the government, which forces would-be savers to scramble to store their money in harder assets, such as a house, which only makes the matter worse. The blame doesn’t go to the boomers, the blame doesn’t go to the older generations, the blame goes to broken money.

The market needs a savings tool. If the money doesn’t fulfill that need, the market will find one that does.

Or in fiat’s world, it will make one. The economy has become extremely financialized in place of the money falling short as an effective means of saving. People are often told they need to “make their money grow.” Why do you think this is? Because if they simply save their money, it will lose value. It must “grow” if they want to merely maintain the value of their money. Consequently, the financial industry has exploded in size and created a dizzying number of financial tools and instruments to, “make your money grow.” 401ks, retirement accounts, mutual funds, index funds, ETFs, ETNs, money market accounts, robo-advisors, certificates of deposit, real estate investment trusts, 529 college savings plans, Coverdell education savings accounts, UTMA/UTGA integrated investment accounts, pension plans, debt securities… just to name a few.

Also included are the millions of people involved in creating, selling, and managing these instruments, all in the name of providing an effective means of saving. Entire careers are dedicated to this effort. Entire companies are built on this premise. Heck, an entire industry has been built on this premise. Even better? All of them take a percentage fee for “making your money grow.” They make money off of making your money grow because your money needs to grow because the money is broken.

Money adequately fulfilling its duty as a store of value would completely wipe this engineered nonsense off of the face of the economy. All of that money spent “making your money grow” would then come back to the people. Why would you need a 401k filled with stocks and bonds and mutual funds and ETFs and index funds, and a financial company managing that retirement account, who charges you a fee to do so, if you could simply save and store your value in the money itself? The answer is, you wouldn’t. The industry of “money management” would go out the window. Good. It is unproductive to allocate resources to “making your money grow” when we can simply use a money that grows itself. Those resources include incredible amounts of brainpower, money, and time that can otherwise be used in more productive ways. The fiat financialized economy is a massive cesspool of waste. This is the product of broken money.

Private equity firms and the like are a similar type of cancer, not inherently, but sprouting from the cancer that is fiat. Only accredited investors and qualified clients worth at least $1 million get access to these money managers, which is another great way to create a wealth gap. In case you didn’t know, more than 33% of homes on the market are being purchased by private equity firms or institutional investors (https://jacobin.com/2024/05/single-family-homes-rentals-wall-street) . These institutions have no interest in residing in these homes, rather, they are viewed as a pure investment, exacerbating the growing unaffordability of living. Journalists and media outlets will often point the finger at these institutions and demand laws and regulations be put in place, but that is not the root problem. The root problem is the money that incentivizes the purchasing of a house as an investment in the first place.

If the money outperformed houses as a store of value, why would a private equity firm invest in a house? So they could lose money? If a house outperformed the money as a store of value, wouldn’t it be smart to get rid of the money and invest in a house?

Private equity firms aren’t to blame – it’s the money. It is what lies at the root of it all. Shelter becoming more and more unaffordable is a symptom of the disease. The disease is the money. The disease is fiat.

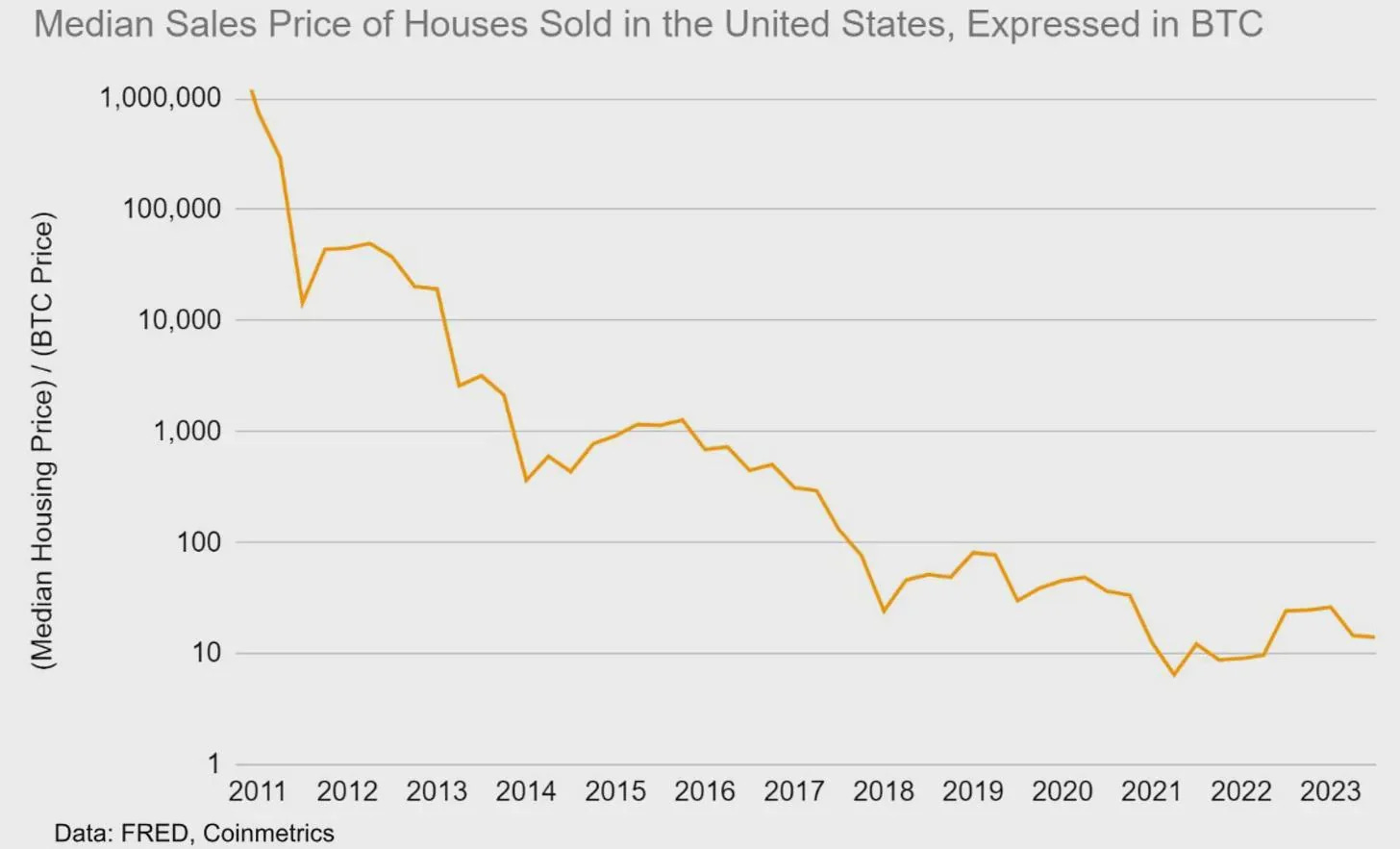

If you removed the fiat disease and shifted the monetary system to Bitcoin, what would the price of a home be over time?

https://www.reddit.com/r/Bitcoin/comments/1abek0f/median_selling_price_of_a_house_in_america/

It would actually go down! Shelter would become more affordable! What a wonder! It’s as if the money is the problem and the solution.

In 2011, it would have cost over $200,000 to buy an average home in the United States. In 2023, it would have cost over $400,000. In 2011, it would have cost over 1,000,000 bitcoins to buy an average home in the United States. In 2023, it would have cost just over 10 bitcoins. Priced in fiat, the cost to buy a home more than doubled. Priced in bitcoin, the cost to buy a home fell by over 99%.

A house is not a savings tool. It is a house; a place to live, a place to gather, a place to shelter, a place to build and grow a family. By using the fiat monetary system, we are increasingly stripping away the ability for human beings to buy, own, and live in a house. Now, zoom out and realize the entire economy is denominated in fiat. The entire economy is like a house; more expensive, harder to obtain, less affordable. By using the fiat monetary system, we are increasingly stripping away the ability for human beings to live.

Why do you think population growth rates are collapsing to species-threatening levels? If life is getting more expensive, it would causate that less and less people would want to bring another life into the world. As the burden of life grows, the desire to create and nurture new life declines.

https://ourworldindata.org/population-growth

Simply by switching the monetary denominator to Bitcoin does everything become less expensive, easier to obtain, and more affordable. In our example, the nature of a house did not change from 2011 to 2023, but the monetary denominator did. Fiat is a distorted form of money, as it fails as a store of value, thus, the economy priced in fiat is distorted. Bitcoin is a true form of money, thus, the economy priced in bitcoin is true. A house is built in 2011, sits and rots away for the next twelve years as the material used to construct the house ages, and doubles in value. That makes no logical sense. A depreciating asset should not appreciate in value. Then you realize, it is not the house that has increased in value, it is the supply of money used to price the house that has increased. It is fiat’s inflationary system. It is not the house, it is not the person who bought the house, and it is not the lack of regulations. It is the money. That’s why by simply changing the monetary denominator to bitcoin, you get the true value of the house. A depreciating asset depreciates in value when true money is used. What a wonder.

In fiat’s world, everyone must become a hedge fund manager to store their value. Insanity. You work to earn money, and then you must work again to save its value. You must find and pay for a financial advisor, or you must find the right group of stocks, you must put a little money into bonds, a little into mutual funds, a little into an emerging markets ETF, a little into a money market fund, and all the while, you must spend your hard-earned money for the right to do so. If you don’t, your money is guaranteed to lose value, which means your time and energy spent earning the money is effectively stolen. Insanity.

What financial advisors, or you, are attempting to do, by crafting an optimally diversified portfolio, is create superior money. Superior money is the superior store of value. What fiat’s financialized economy is trying to do is successfully engineer a superior store of value. But, the superior store of value is not composed of 500 companies, or a rotting away collection of wood on land, or a treasury bond from a Ponzi scheme, or a combination of all three. The superior store of value is itself. It is not a combination of subjectively-selected assets grouped together at subjectively-decided percentages. It is one thing that does not need another thing.

In Bitcoin’s world, you can simply save in bitcoin. That’s it. You earn bitcoin, you save your bitcoin, and your time, energy, and value are properly stored.

Bitcoin isn’t a good store of value, it is the best store of value. Compare Bitcoin to other stores of value like equities, real estate, debt instruments, precious metals, art, and collectibles. Equities can be endlessly diluted, rely on business execution, have competitive risk, regulatory risk, jurisdictional risk, key-man risk, and time risk. What company has been around forever? Real estate has maintenance costs, property taxes, risk of physical deterioration or complete loss due to natural disasters, insurance costs, and tenant risk. Debt instruments have default risk, currency risk, and no fixed supply. Precious metals are bound by the physical world, difficult to transport, and have an unknown supply limit. Art is extremely subjective, illiquid, and non-fungible, as are most other collectibles.

Bitcoin is comparatively simple; fixed supply, known issuance schedule, not tied to any country, company, or employee, can be held indefinitely at no cost, has no physical restrictions, and is secured by the strongest computer network humanity has ever seen.

Combine this with the fact that Bitcoin maintains the most liquid 24/7 market in the world. It’s a Saturday at 11:30 am and you want to sell your equities on the stock market? Too bad, the market is closed, you can’t get your money. Want to sell your piece of real estate in five minutes? Good luck. Meanwhile, you can transact with Bitcoin at any time of day, every day.

Why do you think Bitcoin has been the best performing asset since its inception in 2009? Maybe because it is the best asset. The best representation of time and energy is rationally going to store your time and energy the best. What better asset is there than the one that stores your time and energy the best? You might not believe in Bitcoin, but the market clearly does.

Bitcoin is savings technology. It has been designed to store and transfer your value over time better than anything else. That’s why it has done exactly that, and why it will continue to do exactly that. The proof-of-work speaks for itself.

What more do you want from a savings technology than what Bitcoin offers? It doesn’t cost anything to hold. It has no physical burdens. The entire protocol is open-source, transparent, and cryptographically verifiable. It is finitely scarce, your value cannot be inflated away. There is no middleman to prevent you from transacting with it. You do not need permission to access it. It is censorship resistant. It is foundationally decentralized, nobody can manipulate the network. It is infinitely divisible and perfectly fungible.

Guess who has stored their value the best across the entire market through the time Bitcoin has been alive? Those who own bitcoin. Rich or poor, black or white, healthy or ill, young or old, Bitcoin offers you the best place to store your value. Everybody has a store of value problem, until they don’t.

Fiat fundamentally destroys the function of money; it fails as a store of value. Those who choose to save in fiat today are guaranteed to become poorer tomorrow. This is the result of an inflationary system controlled by a central authority that can print money to infinity in accordance with laws granting them a monetary monopoly. You can save your fiat elsewhere and possibly store your value with risk included, but that is not the purpose of money. In no maximally prosperous world would you have to risk your money to save your money. Money is a tool that, in part, enables you to store your value over time, without additional risk, so that you can fairly spend your money at any point in your life without having to worry about its purchasing power declining. With fiat, or anything else compared to Bitcoin, the market forces you to introduce the need to “make your money grow” and apply risk to your savings. Savings are savings. Risky investments are risky investments. Fiat has convoluted the two because there is no other option in the fiat world; savings have to become a risky investment.

A safe haven for our money, aka a superior form of money, is what allows us to plan for our future. Fiat distorts this possibility and humanity has tragically suffered. Fiat has engineered “tools” like retirement accounts, which are supposed to help you retire. But if you want a retirement account, you must pay somebody to create and hold one for you, you must apply risk to your money, and the system won’t allow you access to your money before their mandated retirement age of almost 60 years old, unless you want to pay them even more money in the form of an early-withdrawal penalty, and even when you get to 60 years of age, you cannot access all your money at once, you must again abide by their rules unless you want to pay more penalties. The system is designed to keep you chained to it.

Opt out, choose Bitcoin.

Brilliantly expressed.🙏🏻

Another piece in the Bitcoin puzzle illustrated with clarity.

Thank you.

无与伦比的文章 你完美的展示了 比特币的意义