$100 million for the price of one Bitcoin is a MASSIVELY conservative estimate.

You're not bullish enough.

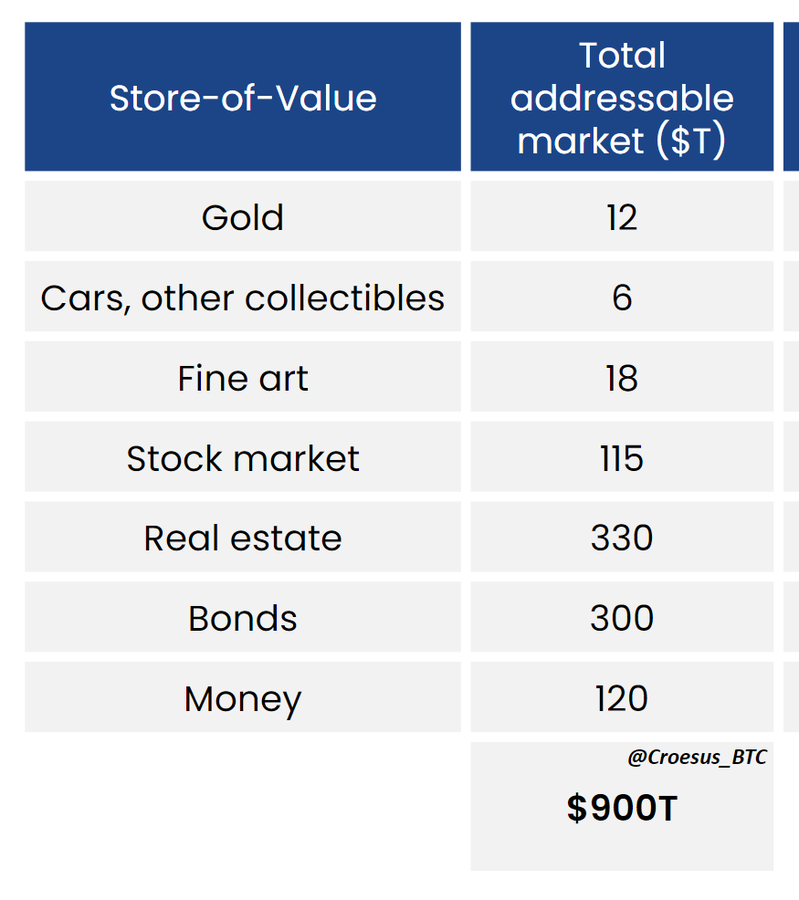

Current global wealth is measured at ~$900 trillion.

Bitcoin’s design means that it is a black hole for all monetary premiums.

Bitcoin is the best store of value in the universe, because of its design, and that means any and all dollars that have been put into other stores of value (above their perceived utility value) will funnel into Bitcoin.

By definition, a good is a sufficient store of value if the holder can sell the good on the market at a later date and recover at least the same value that the good had when the holder acquired it.

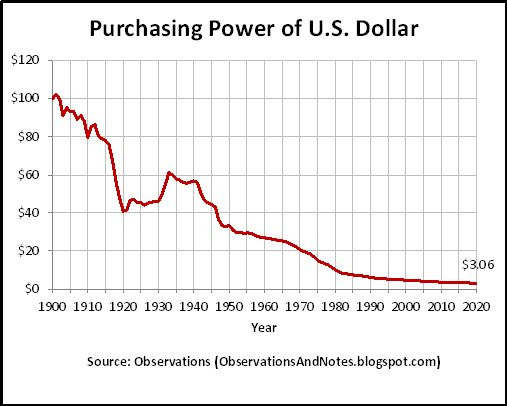

The U.S. Dollar has proven to be a poor store of value, incentivizing users to put their U.S. Dollars in alternative assets (bonds, stocks, real estate) in order to at least maintain their money’s purchasing power.

The entire dynamic changes when the money itself is the best store of value.

This is Bitcoin.

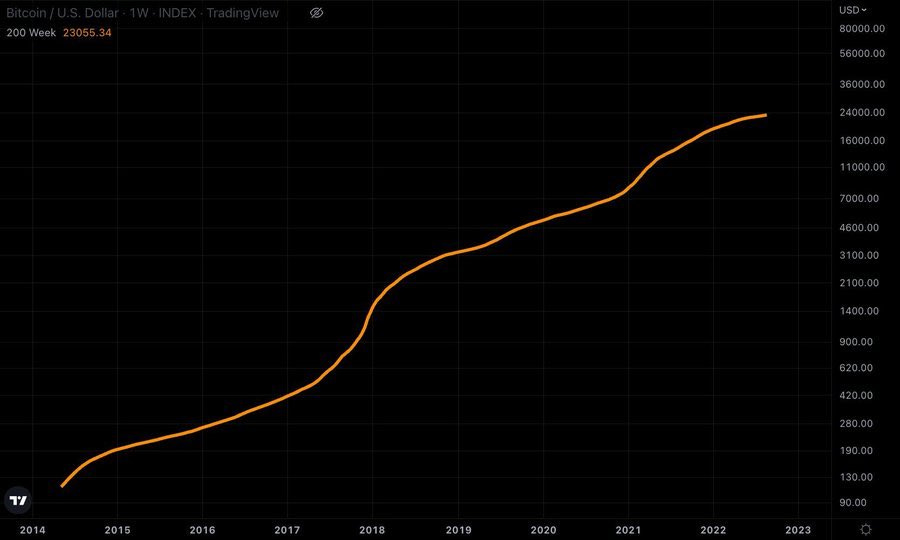

Measure Bitcoin’s performance over the long-term (200 week moving average) and at no point would you have lost money on your investment.

With Bitcoin, no longer do people have to exchange their currency for assets in order to keep up with inflation. They simply store their money in the money itself.

Bitcoin has been and will be the best store of value in the universe for the entirety of its existence, because of its design. There is no second best.

Verifiable, digital, and absolute scarcity is a one-time innovation much like the number zero. Once it’s been created, it’s been created. There is no point in replicating Bitcoin’s scarcity because it already exists, much like anyone claiming they have reinvented the number zero would be laughed at, “Nice try, we already have it. You are wasting your time.”

Because of this, all the money that was once poured into alternative assets in an attempt to effectively store people’s value now gets drained out of those assets and poured into Bitcoin.

Additionally, new money created by fiat that would have been placed into those alternative assets now gets placed into Bitcoin.

This is where math starts to take over.

Bitcoin will increasingly eat into every asset class.

All $120 trillion of money will be placed into Bitcoin and all $300 trillion of bonds.

Real estate still has a marginal cost of production and utility price, but Bitcoin will take most/all of its monetary premium, amounting to $250 trillion of the $330 trillion real estate market.

Bitcoin will take $95 trillion from the stock market, $15 trillion from art, $3 trillion from other collectibles, and $10 trillion from gold.

This means there will be $793 trillion allocated to Bitcoin.

$793 trillion divided by 21 million (the total amount of bitcoins that will ever exist) equals $37,761,904 for ONE Bitcoin.

But the math is only beginning.

See, $793 trillion is in today’s dollars.

Assuming a conservative 4% inflation rate over the next five years, the nominal value increases to $965 trillion dollars. Which would make the USD price of one Bitcoin $45,952,380.

What if we increased the timespan to 25 years at 4%? That's a nominal value of $2.114 quadrillion.

USD price of one Bitcoin = $100,667,000.

What if we made the inflation rate 10% over 25 years? Nominal value $8.592 quadrillion. One #Bitcoin = $409,142,857.

100 years at 5%? $104.280 quadrillion.

One Bitcoin = $4,965,714,285.

But wait.

There are 21 million bitcoins that will ever be in existence. 1 million of those bitcoins are in Satoshi Nakamoto's wallet, who has disappeared. Gone forever.

Approximately 6 million more bitcoins have been lost from buyers improperly storing their coins.

21 million minus 7 million = 14,000,000 bitcoins available.

100 years at 5% is $104.280 quadrillion allocated to Bitcoin. But if we divided that number by 14 million instead of the presumed 21 million…

One Bitcoin = $7,448,571,428.

Now, this is number hysteria. In 25 years nobody will be willing to trade their Bitcoin for U.S. Dollars because those dollars will be worthless. Thus, it is a fool's errand to price Bitcoin in U.S. dollars.

Instead, price Bitcoin in all of the world's prosperity, because in 25 years, every good, service, technology, and other marketable item will be priced in Bitcoin.

If you had all 21 million bitcoins, you would be able to buy all of the world’s prosperity.

Everything in the world divided by 21 million bitcoins.

World prosperity is an infinite, incalculable number.

Infinity divided by 21 million is…

Infinity.

The true value of Bitcoin is infinite.

So, yes, $100 million dollars for the price of one Bitcoin is a MASSIVELY conservative estimate.